Avison Young’s latest Commercial Real Estate Investment Review shows that Central London’s commercial real estate market registered increased investment demand in the first half of 2015. At the start of 2015, political uncertainty in the U.K. was the key concern among investors. However, after May’s election result, the U.K. regained its safe-haven status against a backdrop of Eurozone uncertainty and stock-market jitters in Asia.

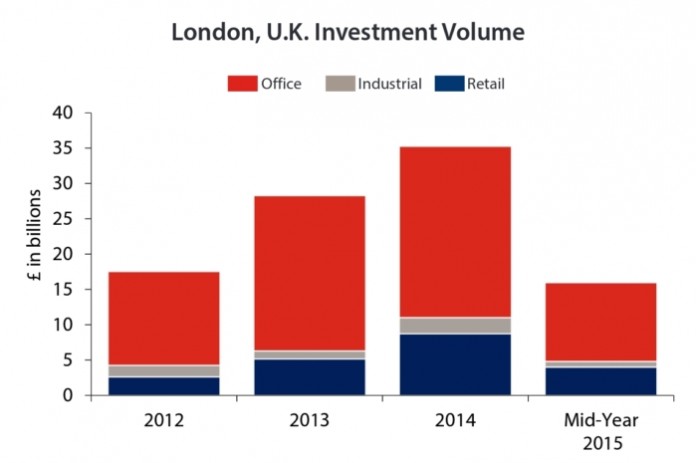

Central London saw a 26% increase in investment volume year-over-year, with nearly £16 billion in transactions during the first half of 2015. Despite the increase in sales volume, the London investment market is still characterised by an imbalance between supply and demand. It is estimated that the amount of money seeking Central London investment property was £40 billion at mid-year 2015 compared with £28 billion a year earlier. In effect, the £8.7 billion invested in London property in the second quarter of 2015 is covered more than four times by money parked on the sidelines due to a lack of available assets.

This abundant capital also explains why yield compression has returned as a feature of the investment market. Central London office yields have fallen to a new low of 4.2%, with prime yields down to 3.1% in the West End. Further downward pressure on yields is expected due to the amount of money being pushed into the investment market, the market’s appeal to investors, and the opportunity for rental growth across most sectors.

Some overseas investors have sold London assets. Asian investors have sold £2.9 billion of property in the last 12 months – almost three times the amount this investor group sold in the previous 12 months.

Looking forward, 2015 is expected to be a record year for investment: Yields have further to fall (but not much), and investors may seek higher returns away from the core areas of London and into the surrounding regions.