Figures released by Knight Frank reveal that vacancy levels in the M25 declined sharply in the final quarter of 2013.

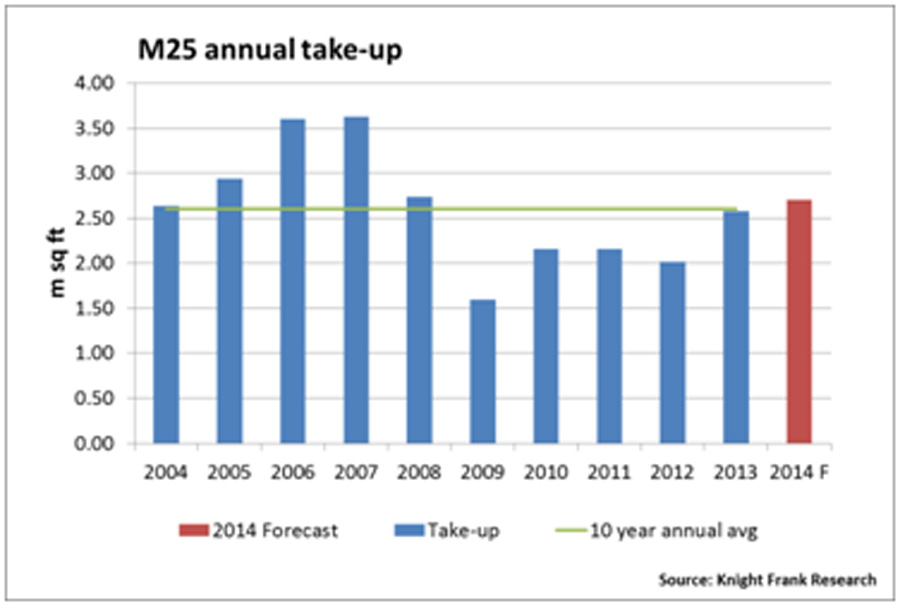

Accelerating growth in the economy was reflected in a significant improvement in occupier demand across the South East during the second half of 2013. Robust take-up of 612,000 sq ft in Q4 took the annual total for 2013 to 2.58m sq ft, 28% above the total for 2012 and its highest since 2008.

Q4’s largest deal took place at FC200 in West London, where Bechtel leased 77,692 sq ft at a headline rent of £28.50 per sq ft. The M4 markets remained a key focus of take-up, with other key deals in Q4 including Honda’s lease of 69,624 sq ft at Reflex, Bracknell and Abbott Laboratories’ lease of 53,283 sq ft at Building 1, Vanwall Business Park, Maidenhead.

Strong take-up and a relatively limited 367,000 sq ft of development completions during 2013 have prompted a sharp fall in overall availability. The M25 vacancy rate fell sharply in Q4 to stand at 6.9%, its lowest level since Q2 2008. Meanwhile, the M4 vacancy rate fell from 9.0% to 8.3% during Q4, its lowest level in over a decade.

There are clear signs that developers are now responding to the tightening of supply, helped by a marked improvement in investor demand. The tightly supplied markets to the West of London and the Thames Valley are the main focus of speculative development, with construction activity in the M4 increasing by 86% during Q4 to stand at c.700,000 sq ft, its highest level since Q1 2009.

Ryan Dean, Partner, South East Offices, comments; “The rebound in occupier activity in 2013 surpassed our initial expectations from 12 months ago and we are encouraged by the prospects for 2014. Knight Frank expects take-up to show further improvement, in line with the return to more consistent levels of growth in the UK Services sector. We forecast M25 take-up in 2014 to surpass 2013’s level to reach 2.7m sq ft, which is above the 10 year annual average of 2.6m sq ft”

“Arguably the biggest threat to transactional activity now lies with the limited levels of existing new and good quality second-hand product. Supply has reached critical levels in a number of the more resilient Thames Valley markets, and we expect developers to increasingly seek out new opportunities in these locations”.

“The current dynamics of supply and demand point to continuing rental growth in 2014, and we expect a host of transactions in the key Thames Valley markets to achieve rental levels well in excess of £30 per sq ft”.