UK cities, shopping centres, restaurants, offices, and meeting places have been radically hit and changed due to the Covid-19 health crisis, in an incredibly short period of time. This is what has emerged from a study carried out by Mytraffic, a start-up specialising in the analysis of pedestrian and vehicle flow for companies and cities.

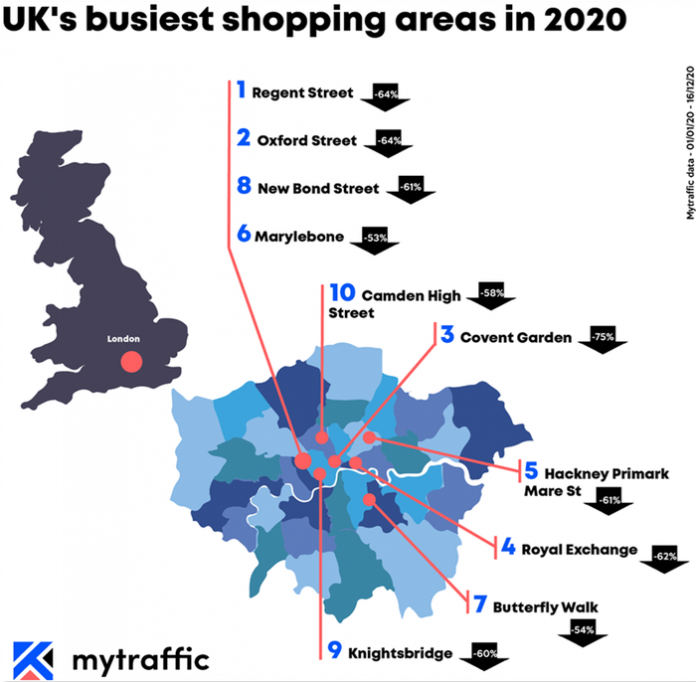

Through the statistical analysis of anonymous geolocation data, Mytraffic estimates the traffic of visitors, pedestrians or vehicles in a neighbourhood, a street or in front of a business commercial address, offering retailers, real estate players & cities specific and accurate data to ease and accelerate strategic decision-making. As 2020 is ending, Mytraffic ranked the UK’s top shopping areas based on footfall traffic, benchmarking these metrics with the 2019 performance.

Ranked in the #1 position, London’s Regent Street remains the UK’s most attractive shopping area, with a high traffic density, driven by its flagship stores and international brands. Despite remaining at this top position, the West End’s major shopping street was strongly impacted by the Covid-19 crisis, with a drop in visitor’s per square metre of -64% compared to 2019.

At a close #2 position in Mytraffic’s ranking, Oxford Street remains one of Europe’s busiest shopping streets. Nonetheless, also located in the West End, it experienced the very same decrease in visitors of -64% compared to 2019.

Though undoubtedly being another of London’s top shopping and entertainment hubs, London’s Covent Garden experienced an even more dramatic decrease year-on-year in footfall traffic, with a -75% drop in 2020 versus 2019.

Even if all expect global economic recovery, the long-lasting health crisis drives up volatility in traffic flows due to variable sanitary policies over time. In this challenging time, the accurate measurement of pedestrian and vehicle traffic brings high value for retailers, shopping centres, real estate professionals and cities in their strategic decisions.

“Beyond human toll, the Covid-19 crisis has also had a massive economic impact on retailers & real estate players all across Europe. The variety of public decisions to limit sanitary effect, being national or local, have resulted in a high volatility in footfall & then higher business risk for the whole retail industry. We have developed a complete tech platform, to measure vehicle and pedestrian traffic all over Europe, to provide the retail industry with accurate insights & data and to reduce the industry’s business risks” says Hakim Saadaoui, Mytraffic CEO.

Thanks to Mytraffic Analytics cutting edge software, all players in the industry can have access to accurate data measurement of pedestrian or vehicle traffic in a shopping area, in a shopping centre or in front of a specific commercial address.

Over 250 companies have already relied on the Mytraffic insights, globally, including renowned international brands such as Haagen-Dazs, McDonald’s, Liu Jo, Subway, Jimmy Fairly, Lancôme, Cushman & Wakefield, BNP PARIBAS, Carrefour and more.