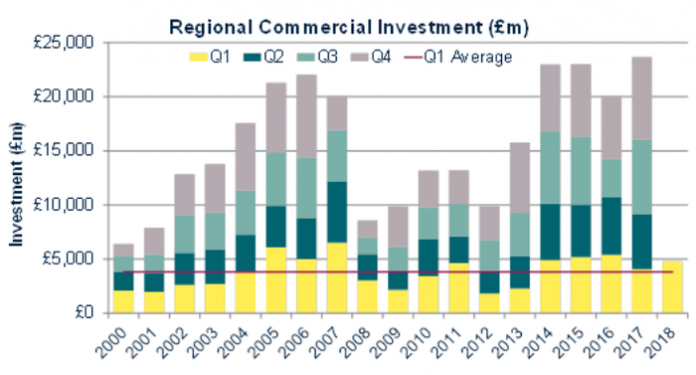

Investment into UK regional commercial property reached £4.8 billion in the first quarter of 2018, 26% above the long terms Q1 average according to new data from Savills.

The firm notes the most popular asset amongst investors was offices which attracted £1.4 billion of capital. Key office transactions included the acquisition of 55 Colmore Row, Birmingham by TH Real Estate for £98 million from IM Properties and L&G LPI Income Property Fund’s £50 million acquisition of 3 Atlantic Quay, Glasgow. Industrial and retail assets transacted £1.1 billion and £1 billion of investment respectively.

Property companies were the most active investors, spending £1.5 billion in the regional commercial property market. This was followed by the UK institutions with an investment total of £1.4 billion as they returned following a quiet 2017; a 30% increase on the £1.1 billion invested in the first quarter of 2017.

Richard Merryweather, joint head of investment at Savills, comments: “The UK regional commercial property market has had a strong start to the year following several high profile deals. Office stock continues to be high on the wish list for both domestic and overseas investors as limited new development over many years has caused a tightening in regional office yields.”

Overseas investors continued their activity in the regional markets, investing £1 billion in the first quarter of the year according to Savills. The most active investor by geography was the US, accounting for £463 million of acquisitions, this was dominated by LCN Capital Partners’ acquisition of Aberdeen International Business Park for over £100 million.