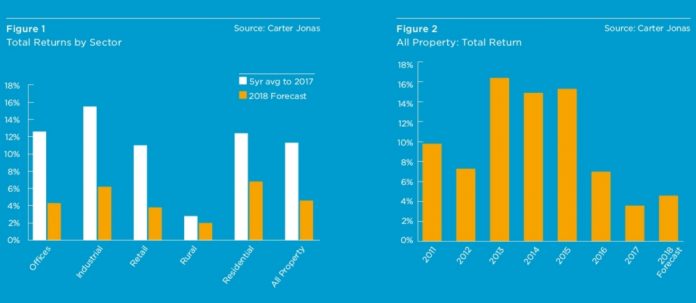

Carter Jonas, the national property consultancy, is forecasting positive total returns for 2018 of 4.6% in its annual All Property Index released this month. This is an increase from 3.6% achieved in 2017, but remains some way off the high returns seen in 2015 of 15.2%, and the five-year average to 2017 of 11.3%. The All Property Index includes the performance of office, industrial, retail and residential property alongside the agricultural sector providing a comprehensive overview of the UK’s real estate market performance.

Commercial Real Estate

Commercial property is likely to continue to face pricing pressure as we head into 2018. The limited supply of good quality investment stock in the strongest performing sectors helped, to some extent, mitigate against sharp falls in capital values earlier in 2017, which have now shown signs of stabilising. Volatility over the past 12 months has meant investors are still focussing primarily on long term income, whilst opportunities for development or successful asset management will also remain a favoured option in 2018 for many investors.

The looming spectre of Brexit has placed some downward pressure on rental growth for offices in central London over the last 12 months with some business decisions subject to delay. Occupier demand however continues to confound expectations, which has been evident in resilient letting volumes. Some further re-pricing of London rents is anticipated in 2018, whilst the strongest regional office markets have witnessed further rental growth and good levels of demand from a broad range of businesses, inclusive of further large- scale commitments from the public sector. Overall average returns of 4.3% are forecast for UK offices, a marginal increase of 0.1% on 2017.

Industrial will continue to outperform the other commercial markets with projected total returns increasing from 4.2% in 2017 to 6.2% this year. Rental growth and capital values will be driven by the shortage of land close to large urban conurbations where there is high demand for logistics to support further growth anticipated within the e-commerce market.

The outlook for the UK high street remains challenging. Whilst prime retail assets may see more stable levels, with overall returns increasing year on year to 3.8% in 2018 (up on 3.4% in 2017), the poor performance of the secondary retail market and the increasing popularity of online shopping will continue to impact the market, which is expected to underperform against other asset classes.

Scott Harkness, Head of Commercial, said: “Political turmoil was without doubt the low of 2017. Cabinet changes and in-fighting aside, the ups and downs of the Brexit negotiations have had a very real impact on UK commercial space in some markets. The bright spots of the UK economy have been the strength of the life sciences and technology sectors, which have benefited from commitment by both UK and international trade bodies in 2017.

“The UK industrial strategy outlines proposed deals to secure over £20billion of investment into innovative and high potential business areas within the UK. These sectors will continue to grow next year, which will have a positive impact on the commercial property sector by increasing demand for occupational space at a time of uncertainty. As a result, we will see greater investment in knowledge centres, university towns and industry corridors which will spread economic benefits beyond the major business hubs.”

Rural

The land market remained active during 2017 despite the uncertainties surrounding the future support system in the agricultural sector post-Brexit. Land values have however been impacted across the country, reducing to £8,972 per acre at the end of 2017 (compared with £9,778 per acre at the end of 2016). Over the next 12 months, the expectation is for a slight uptick in pricing across all areas of the UK except around the M25 region, which will keep returns subdued. As a result, total returns for rural property are forecast to reach 2.0% by the end of 2018 – an improvement on the results witnessed last year of -8.9%.

Tim Jones, Head of Rural, said: “The ongoing Brexit negotiations mean that the outlook for rural property will remain uncertain, however the release of the UK’s Agricultural Bill this year will be an opportunity to clarify key issues, including farming productivity and environmental enhancements, helping to restore confidence and embolden existing and future rural land owners. Support payments will continue to be a central issue, and Environment Secretary Michael Gove’s acknowledgement of this at the Oxford Farming Conference will, to a degree, supress concern surrounding the future of subsidies beyond 2020. His commitment to designing a scheme that steers away from the volume of land owned and instead focussing on owners whose businesses are designed to benefit the environment, including planting woodland and returning cultivated land to more natural states, will be championed throughout the agricultural community.”