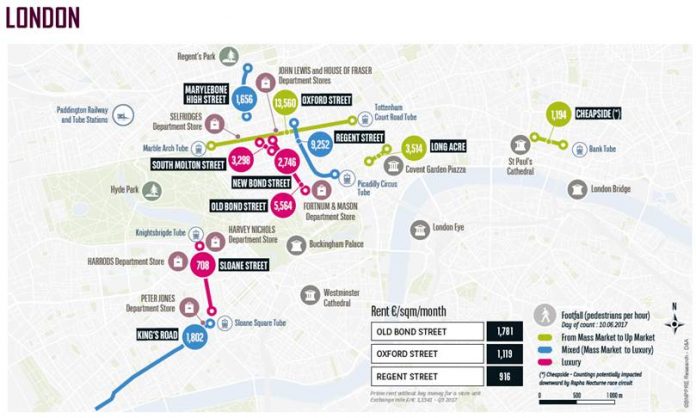

Oxford Street has emerged as Europe’s busiest shopping street in new footfall analysis of the most famous high streets in 23 European cities published by BNP Paribas Real Estate.

With footfall of 13,560 people an hour, Oxford Street topped the overall ranking with Regent Street (9,252) in 9th place. Munich, Madrid, Frankfurt and Paris completed the top five.

In analysis of Europe’s top 20 luxury high streets, London had four entries – Regent Street (9,252) in 3rd, Old Bond Street (5,564) in 7th, South Molton Street (3,298) in 13th and New Bond Street (2,746) in 16th.

Joanne Skilton, retail agency, BNP Paribas Real Estate, said: “London retail continues to defy predictions of a post-Brexit slowdown. Its international appeal as a top shopping destination and its position as a prominent cultural and educational centre mean that visitor numbers remain high. While the currency discount from sterling’s devaluation has undoubtedly attracted some opportunistic retail tourism, it is the unrivalled retail offer of the West End that keeps London on top.”

Nick Robinson, retail analyst at BNP Paribas Real Estate, said: “The allure of Oxford Street’s world-leading department stores such as Selfridges and John Lewis continues to attract footfall from both tourists and domestic shoppers alike. The addition of Crossrail in 2018 will enhance both ends of the street and ensure that it continues to attract a plethora of global retailers for years to come.”

MASS MARKET

Oxford Street confirmed its position as the number one European retail destination, recording the highest daily footfall of any pitches surveyed by BNP Paribas Real Estate. The constant allure of its major world leading department stores such as Selfridges and John Lewis has attracted footfall from both tourists and domestic shoppers alike. As a result of this the street continues to attract global retailers such as Reserved, Simit Sarayi and Jurlique over the course of the past year. Whilst the Eastern end continues to improve with impending opening of Crossrail in May next year, the traditional retailing area around Bond Streetstation has seen rents grow to £1000 psf ZA over recent years. As of Q3 2017 Oxford Street’s vacancy rate fell to 4.8%, perhaps allaying any fears of a post Brexit retail wasteland.

Long Acre has painted an equally positive picture. Retailers such as & Other Stories and Amorino have been recent additions to the retail offer. Whilst the pitch tends to attract mid-market retailers, the presence of Seven Dials to the north and Covent Garden to the south ensures that Long Acres retail mix has a more edgy mix than some of the West End’s other mass market streets.

Cheapside continues to thrive as the primary retailing destination for the City of London. Because of the demographic of the shopper around the pitch, the comparison retail provision has been mass- upmarket with retailers such as Hugo Boss, Ted Baker and Massimo Dutti having prominent units. The footfall count was low in comparison to the other retail areas surveyed, but reflects Cheapside’s position as a weekday retail location, with the count being conducted on a Saturday.

LUXURY

Over the past year, the London luxury market has benefited from both extra footfall and increased sales, with overseas tourists purchasing luxury goods at a post Brexit vote currency discount. Bond Street remains the global luxury street. Whilst some of the sky high premiums witnessed a few years ago have reduced, sustained international luxury occupier demand has ensured that upward pressure still exists for the best units on the street – Prime Zone A rents currently stand at £2,225 psf ZA. Whilst retailers such as Chanel and Louis Vuitton have been the traditional drivers of footfall down Bond Street, brands such as luxury jeweler Tasaki and high end womenswear retailers Chloe and Alaia have been recent additions to the area.

Sloane Street continues to provide a platform for large format stores for luxury brands but generally benefits from seasonal trade. There have been recent upsizes made by Fendi and Hermes. Burberry has signed to relocate to Chelsfields K1 development. Zone A rates on Sloane Street are consistent at circa £1,000 Zone A.

On South Molton Street, there has been a flurry of recent activity. Grosvenor Estate has let several of their units to new entrant brands. South Molton St has always been a little cyclical in terms of occupational demand but Zone A rates have consolidated recently at circa £450 Zone A.

SPECIAL

Regent Street continues to attract international retailers seeking large flagship units. The Crown Estates active curation of the street also draws consumers to the street. Over the course of the year traffic free events such as Summer Streets and NFL on Regent Street have ensured that the street remains an authentic and dynamic retailing experience.

The King’s Road remains Chelsea’s main retail destination. The pitch is home to a wide mix of both high end and mass market retailers. The street has benefitted from active placemaking initiatives from the Cadogan Estate, with areas such as Duke of York Square being used for other events which help generate footfall around the Kings Road. As such, occupier demand remains strong in the area and vacancy rates stood at 4.8% in Q3 2017.

Marylebone High Street, one of London’s most prestigious retail pitches, also provides consumers with a mixed retailing experience. Another area which has benefitted from deliberate curation – the Howard de Walden estate has transformed Marylebone High Street into a retailing and leisure location which appeals to both tourists and residents. Rents on the street currently stand at £500psf ZA following years of strong rental growth.

Methodology

This first-ever study has been co-ordinated by the Research and Leasing teams of BNP Paribas Real Estate across 23 cities throughout Europe. It was carried out on Saturday 10 June 2017 between the peak hours of 14:00 and 16:00, taking into account the cultural trading differences of cities. Each city was divided into “Mass-Market to Upmarket” and “Luxury” categories and between three and 10 streets were selected, depending on scale and population of the city.