Supermalls set to outperform physical retail growth, as focus on leisure and food service attracts millennials, says GlobalData.

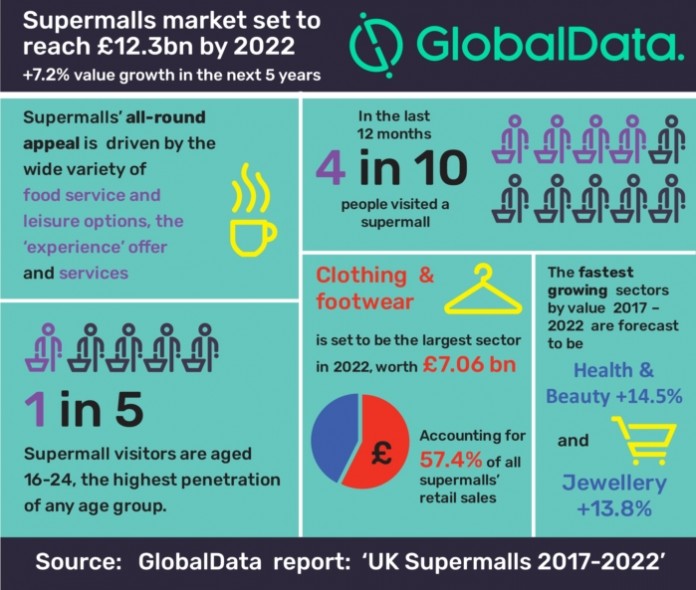

The UK Supermalls market is forecast to rise 7.2% over the next five years, outpacing growth in physical locations, forecast to be 5.0% (across non-food sectors), according to GlobalData, a leading data and analytics company.

The company’s latest report: ‘UK Supermalls 2017-2022’ reveals that although clothing & footwear will remain the largest sector and the biggest contributor to growth, smaller sectors within the channel including health & beauty and jewellery are set to be the fastest growing rising by 14.5% and 13.8% respectively.

The all-round appeal of supermalls will drive the market to reach £12.3bn in 2022 helped by the wide variety of food service and leisure options together with consumer desire to spend on experiences and services.

In the last 12 months 43.2% of the UK population have visited a supermall attracted by the wide choice of retailers and products, alongside the experience that a supermall offers.

As Sofie Willmott, Senior Retail Analyst at GlobalData comments: “Our UK Supermalls report shows that younger shoppers have the highest penetration of all age groups, with 69.2% of 16-24 year olds visiting a supermall in the past 12 months affirming the importance of shopping in physical stores for the younger generation. The rising demand of the ‘foodie’ millennial has driven supermalls to focus on their food service offer alongside leisure, with developments planned over the next five years focused on leisure as oppose to retail expansion.”

Fashion retailers such as Primark, H&M and JD Sports have created large format destination stores in supermalls with strengthened product ranges suggesting a new set of key retailers will usurp traditional anchors such as Debenhams, Next and M&S in the coming years.

Willmott explains “Department stores have traditionally been the anchor retailers and have brought credibility to supermalls however as fashion players such as H&M, Zara and Missguided invest in exciting, up-scaled stores demonstrating their brand credentials and offering a broad range, it is questionable whether these longstanding stalwarts are still a requirement.”

A best in class multichannel experience is vital at supermalls to protect against spend shifting online.

Willmott adds; “Supermalls are more attractive to consumers than other physical locations due to the additional services available. However as online sales continue to rise and physical shopping missions reduce in frequency, supermalls must ensure they remain relevant and can offer the same seamless experience that online shopping provides. The promotion of convenient services like CollectPlus lounges and ‘hands-free’ shopping will enhance the customer experience and increase spend per visit.”

A supermall is defined as a large shopping centre that is over 1,000,000 sq ft and usually has annual footfall over 20 million.

Information based on GlobalData’s report: ‘UK Supermalls 2017-2022’.