Global property investment has risen to $1.35tn in the past year despite 12 months of uncertainty across the globe, according to annual research from Cushman & Wakefield.

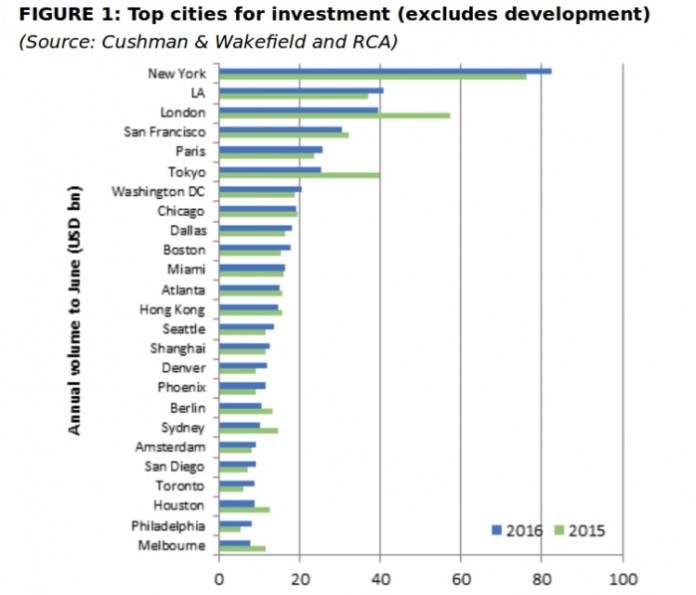

The ‘Winning in Growth Cities’ report is an annual survey of global commercial real estate investment activity which lists the cities most successful at attracting capital. During the 12 months to June 2016, the largest gateway cities increased their share of the market, with the top 25 drawing in 53.3% of all global spending, up from 52.7% in the previous year.

New York once again topped the ranking of cities from a total investment perspective. The US also had the best of the growth, increasing its hold on the list with 15 of the top 25 cities. Another North American city, Toronto in Canada, also made the top grouping, with four European cities, a fall from six last year, and Asia-Pacific holding at five cities.

Meanwhile, targets for foreign investment have shifted, with cross border flows growing faster in America and Asia than Europe, and the ranking of cities also changing. The most notable shift has been London losing its global crown to New York, with volumes in the UK’s capital falling from US$39bn to US$25bn. A range of other gateway markets are also down, including Tokyo, Washington and Frankfurt, due to a combination of limited supply and local competition. Ten of the top 25 cities by foreign investment were in EMEA, nine in North America and six in Asia-Pacific.

David Hutchings, Head of EMEA Investment Strategy, Cushman & Wakefield, and author of the report, said: “Despite the volatile environment, more investors are turning to the stable cash flow and inflation-hedging merits of real estate, particularly given that the fundamentals of the market on the occupier side are holding up well.

“The greater appeal of the US clearly comes out through the data, with its cities dominating in all sectors, and New York top for overall investment and for cross border buyers. However, EMEA’s enduring attractiveness is reflected in having the most cities attracting foreign investment.”

North American region

The report shows that Los Angeles and San Francisco both moved up the list of top cities for investment. Furthermore, the region is home to 24 of the fastest growing 50 larger cities with a volume over $1bn (excluding development). Philadelphia was a particular winner, seeing volumes rising 50.5%, and Toronto, Denver, San Diego and Phoenix all showed very strong increases.

EMEA region

While London lost out as a centre for global investors due to Brexit concerns and high pricing before the EU referendum, it nonetheless remained the region’s leading city for investment. Paris, Berlin and Amsterdam make up the rest of EMEA’s contingent in the top 25 cities list. In terms of growth, Tier 1 cities such as Paris, Amsterdam, Copenhagen and Milan all feature in the top growth list. However, Tier 2 cities also feature heavily, led by Rome and Helsinki, together with regional UK and German markets such as Liverpool, Newcastle, Birmingham, Nuremburg and Stuttgart.

Asia-Pacific region

Tokyo slipped down from second to third in the list of top cities for investment, with Shanghai, Hong Kong, Sydney and Melbourne the other four APAC cities. Singapore joins these five cities in the top list for global investors. Elsewhere, there was some noticeable growth in emerging markets, with Chonqing and Shenzhen in China posting year-on-year investment gains of 866% and 243% respectively.

Investment strategy

Looking ahead, the scale of changes underway in the macro environment – from a slowdown in China, to Brexit, to the US elections – has meant many investors are struggling to decide where they should look for value, the report states.

Brexit has the potential to change the global city hierarchy as other cities vie to take advantage of any uncertainty among London occupiers and investors. However, any gains are likely to be thinly spread and no single city will win out. Indeed, losing out to New York as the world’s biggest magnet for foreign capital could be a short-term reverse for London, with relative pricing already starting to look more attractive as yields elsewhere are forced lower.

In the medium term the net impact on London could be limited if the city succeeds again in innovating and embracing change – it could even increase its leading international role if it develops a yet more global face to the world.

On a global scale, the report also highlights that for cities to stay top of the rankings in the future, they will need to invest more to create efficient, sustainable, safer and healthier places to live, work and visit. In broad terms, cities need to be connected, mixed-use, walkable and transit rich. Increasingly, they also need smart design in buildings and infrastructure as well as a strong focus on their target audience of talent and businesses, particularly for second tier cities.

Carlo Barel di Sant’Albano, CEO, Global Capital Markets, Cushman & Wakefield, added: “Looking ahead, we remain positive about investors’ interest in allocating capital to real estate. Although volatility has declined over the past 12 months overall risks are still evident. While global uncertainty will continue to make investors more cautious, this is counterbalanced by the fact that corporate confidence has held up. Allied to the changes in demand being wrought by new technology, living and working practices, this underpins a robust medium-term outlook for good quality real estate.”

“Furthermore, with changes to society and business only accelerating, the importance of the right property is increasing – suggesting profit potential will be enhanced for the best quality even as it potentially falls for weaker property. In an environment of sustained low interest rates, expectations of higher inflation and volatility in all asset classes underline the role of real estate in portfolio diversification.”

David Hutchings added: “In such a competitive environment, cities must do more to attract workers, not just rely on workers flowing their way. This means creating a brand value that young people identify with, focusing on health and security more than at present, keeping pace with technological change and making a contribution to lifestyles.”