While it has been a slow start to the year for Sheffield’s office market, news of the billion pound Chinese construction deal, confirmation that the HS2 station will now be located in the city centre, and HSBC’s announcement of its proposed relocation to the £480m Retail Quarter in 2019 all underline the attractive nature of the city as a first-class business destination and are positive indicators for future growth, Lambert Smith Hampton’s Q2 Office Market Pulse reveals:

Professional services sector boosts out-of-town take-up

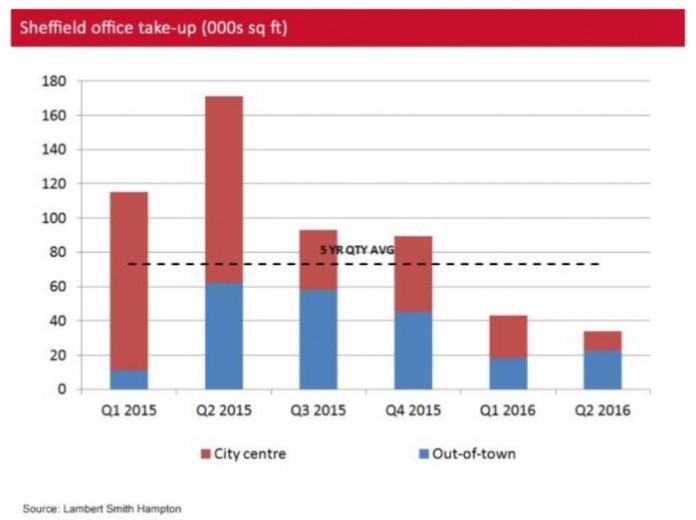

Occupier activity across Sheffield remained subdued throughout the second quarter of 2016, with just 34,000 sq ft of office space transacted; giving a H1 total of 76,961 sq ft across both the city centre and out-of-town markets.

In the city centre, take-up reached just 11,500 sq ft comprising just two deals.

In contrast, the out-of-town market showed signs of improvement, transacting 24% more than the previous quarter to reach 40,675 sq ft for the year. This was largely attributable to the high levels of churn within the professional services sector, which accounted for 58% of the deals transacted.

Looking ahead to H2, we expect to see an improvement in the level of take-up across both markets, with approximately 44,400 sq ft of space currently under offer and further active requirements in the market needing to take occupation during Q3.

New developments provide much-needed boost to grade A availability

The supply of grade B/C space has remained fairly constant throughout 2016 with new space coming to the market at a similar level to that being absorbed.

The completion of 3 St Paul’s Place in Q1 2016 has given a much needed boost to the grade A supply in the city centre, with 61,674 sq ft remaining following Arup’s letting of the top two floors comprising 16,423 sq ft. The second phase of Digital Campus is also now underway and will deliver a further 128,000 sq ft of grade A space to the market in 2017.

City centre’s record rent remains unbeaten

As anticipated, the city centre’s record rent of £23 per sq ft set by Arup at 3 St Paul’s Place remains unbeaten. However, there is still potential for an increase in rents for good quality grade B space should the market show signs of improvement in the latter half of 2016.

Prime out-of-town rents have remained constant at £14 per sq ft in the first half of the year, as have rent free periods and we expect that trend to continue.

Investment volumes fall but Northern Powerhouse will become a safe haven

Office investment activity across Sheffield fell back in Q2, with just one transaction totalling £6m – down more than 80% on the previous quarter, albeit an improvement on the £1m transacted during the same period in 2015. This slowdown in activity is largely attributable to the general uncertainty before the referendum and resultant reaction to Brexit which has seen values fall. Sellers and buyers are therefore struggling to ‘mark to market’ as the political and economic swings make price certainty difficult.

However, the depth of the regional market as a Northern Powerhouse is likely to provide less volatility for purchasers than Central London and subsequently, opportunities will lie in assets brought to the market which offer a defensive play.