Quarterly returns for Scottish commercial real estate fell to 1.2% in the first quarter of 2016, down from 2.0% in the final quarter of last year, CBRE’s Scotland Property Quarterly Report shows.

This continues the trend over recent quarter for slightly lower returns quarter-on-quarter since quarterly returns peaked in 2014. This lower return in Q1 is principally due to a small fall in capital values over the course of the quarter. All Property Scottish Capital Values fell by -0.2%, a shift from +0.6% in Q4 2015.

All three commercial sectors have seen returns slip in Q1, but industrials have been the most resilient. Whilst retail and office returns were both 1.1% in Q1 (down from 1.7% and 2.3% respectively), industrials saw a return of 2.2%, just 20bps lower than in Q4.

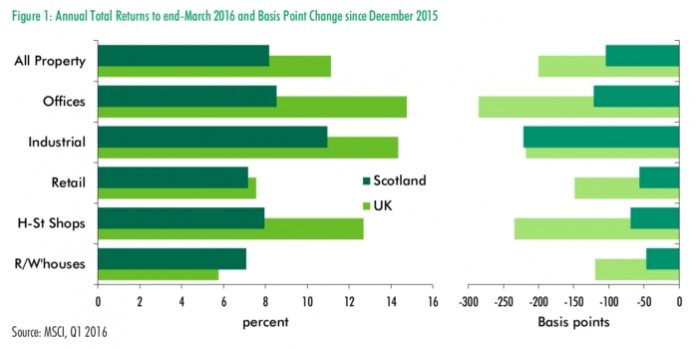

Taking a twelve month view, shows that Scottish retail has generally been more robust than for the UK as a whole. For instance the erosion in quarterly returns has been aggressive in Scotland, and twelve month returns for all retail are the most closely matched between the UK and Scotland. However, there is significant variation amongst subsectors, with Scottish high street shops underperforming relative to the UK, but retail warehouses outperforming.

Capital losses have been felt across all sectors, except for industrials, where values grew by 0.6% during the quarter. The losses can be attributed to weaker rental growth for the office sector, but other sectors saw rental value remain stable during the quarter.

RETAIL

Total returns for Scottish retail fell back to 1.1% in the first quarter, from 1.7% in final quarter of last year. This was entirely due to a slowing and reversal in the pace of capital growth. Values fell 0.3% during the quarter, having grown by 0.4% in Q4. Rental growth, at 0.2% over the quarter remained unchanged. Across the retail subsectors, retail warehouse have been the better performer. Capital values in Q1 slipped by -0.1% compared to -0.3% for standard shops; retail warehouse rents grew by 0.5% compared to zero growth for standard shops.

OFFICES

Office returns in the first quarter fell to 1.1% over the quarter, down from 2.3% achieved in Q4. This relative underperformance from offices can be traced to net falls in both capital and rental values, both of which were -0.3% for Q1. It remains to be seen whether this is a one off, short term blip, perhaps related to the softer market condition associated with the forthcoming referendum on EU membership.

INDUSTRIAL

Industrial total returns outperformed both other sectors in Q1 for the tenth quarter in succession. Indeed the industrial sector is proving to be more resilient to the weaker conditions that have characterised the start of 2016. With a 2.2% return in Q1, this has slipped by only 20 basis point since Q4 and is supported by capital growth of 0.6% and ERV growth of 0.3% over the quarter. Nevertheless the superior ERV growth rate has moderated in Q1, to an annual rate of just under 2%, compared to 3.2% at the end of last year.

CITY LEVEL ANALYSIS

Across Scotland’s cities, the performance hierarchy remains largely unchanged from the last quarter. Across all three cities, industrials performance is either in line with the All Scotland total return (in the case of Aberdeen), or outperformed this benchmark (in the case of Edinburgh and Glasgow). The office markets of the Central Belt also remain notable outperformers when compared with the 8.2% Scottish All Property total return. Only two markets underperform, albeit the margin for Edinburgh retail is relatively small. Unsurprisingly, Aberdeen offices remain the weakest in performance terms, however the pace at which returns have been declining has slowed. Whilst capital values continue to grow in the Edinburgh and Glasgow office markets (up by 6.4% and 5.9% respectively in the twelve months to the end of March), values have fallen by -2.6% in Aberdeen over the past year.

SCOTTISH PROPERTY INVESTMENT

The first quarter has been dominated by a particular active few months for office investment. Edinburgh in particular has been the focus of a number of large lot size deals in Q1, including DEKA’s acquisition of Atria (for £105.25m) and TRIUVA’s purchase of Quartermile 4 (for £68m). As a result almost half the volume of office investment from 2015 has already taken place after just three months.

In contrast investment into other sectors has been much weaker. Overall Q1 investment totalled £519m, of which almost £400m was accounted for by office deals. Industrials have accounted for just £35m and retail, a very low £19m. There have been no industrial deals in excess of £10m recorded so far this year, and only one retail deal above this value: this was the purchase by TRIUVA of units on George Street, Edinburgh, let to Jack Wills and Arran Aromatics and attracting an initial yield of 5.25%.

ECONOMIC OUTLOOK

The Scottish economy grew by just 0.2% in the final quarter of 2015, characterising a year of weaker economic growth for Scotland. Overall, during the full calendar year, GDP in Scotland was 0.9%, compared to 2.3% for the UK as a whole. Much of this underperformance can be attributed to the reduced output from the oil and gas sector, on the back of the low oil price, a consistent feature during 2015. There is also some potential weakness due to uncertainty in the run-up the referendum on UK membership of the European Union.

This is evident in the data for the final quarter. The production sector (which includes the oil and gas sector) contracted by -0.1% in Q4. In contrast other key sectors grew including manufacturing (+0.3%), services (+0.3%) and construction (+0.1%). However, this relative softer growth spell for Scotland should not come as a surprise, given the lower PMI scores for the country, compared to the English regions. Over the three months to April 2016, Scotland’s PMI score, based on business survey evidence, was just 50.0, indicative of a flat economy. However, other UK regions are now at a similar level on the PMI survey.

Retail sales continue to improve in Scotland. In volume terms sales were up 0.7% in Q1 2016 meaning sales were up 2.7% on an annual basis. In value terms, the growth is less impressive at just 0.1% over the first quarter. These rates of growth are now broadly on par with retail sales growth rates for the UK as a whole.