Strong demand and a lack of supply has led to a good start to 2016 for office markets in Glasgow and Edinburgh, according to leading property consultant CBRE’s quarter 1 2016 office market research.

EDINBURGH

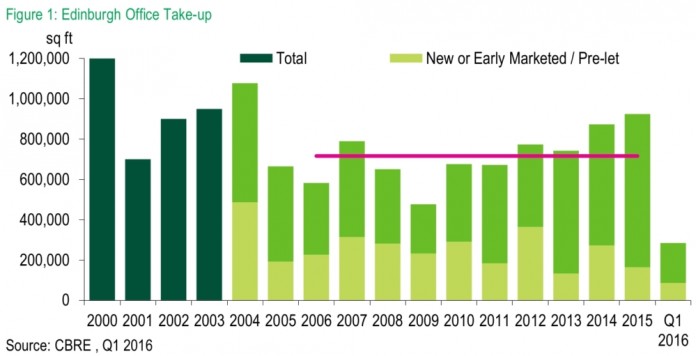

Take-up in the first quarter of 2016 in Edinburgh totalled 283,720 sq ft; this is down 19% on the total from the last quarter of 2015 and reflects the usual year-end spike. The year-to-date take-up, however, has increased by 17% compared to the same period last year.

Overall take-up has been boosted by Napier University’s deal to acquire 107,514 sq ft of space across three buildings at South Gyle Business Park, further diminishing the already low level of out-of-town supply. This resulted in 40% of this year’s overall take-up so far being from the public sector.

The creative services sector continued to be a dominant force in the Edinburgh market, accounting for almost one third of take-up in quarter 1. The biggest deals included Cirrus Logic at Quartermile 4 (70,041 sq ft) and Origo Services at Edinburgh Park (10,971 sq ft).

Availability has decreased by 19% since the end of 2015 and is back down to levels last seen in 2001, representing a 15 year low for the capital. In particular the availability of prime Grade A stock remains tightly constrained with just 351,583 sq ft available, around half the ten year quarterly average. A 25,000 sq ft or larger requirement for new build Grade A accommodation in the city centre can currently only be met in one building, Atria 1.

Prime rents have remained stable over the first quarter at £31.00 per sq ft, however with supply levels very low further uplifts in rental levels are expected later in the year.

Stewart Taylor, senior director in CBRE’s National Office Agency team in Edinburgh, said: “With only two speculative schemes under construction totalling 110,500 sq ft, completion dates for other proposed schemes continuing to be put back and several large requirements in the market place, there will be tears before bedtime.”

GLASGOW

The Glasgow office market also enjoyed a successful start to 2016 with 282,455 sq ft of space acquired for occupation during quarter 1. This is already past the halfway point compared to the full year figures for 2015 and the ten year average for Glasgow.

This strong start is the result of Morgan Stanley signing a pre-let for 154,814 sq ft at Bothwell Exchange, a new development being delivered by HFD Group on Waterloo Street in the city centre.

Take-up was also boosted by further lettings at Glasgow’s newest office buildings including the Association of Chartered Certified Accountants (ACCA) taking 55,744 sq ft across three floors at 110 Queen Street and Registers for Scotland acquiring 17,294 sq ft of space at St Vincent Plaza.

Total available supply at the end of the first quarter stood at 1.63m sq ft, down 5% from the position at the end of 2015, and 13% lower than twelve months ago. The new build stock that completed in 2015 has been very popular with occupiers to the extent that St Vincent Plaza remains the only Grade A new build office building that can accommodate a requirement in excess of 50,000 sq ft in Glasgow.

At the end of quarter 1, the prime rent stood at £29.50 per sq ft. With supply continuing to deplete, further growth in prime rental levels is anticipated in Glasgow city centre.

Audrey Dobson, senior director in CBRE’s National Office Agency team in Glasgow, commented: “We’ve seen unprecedented levels of take-up in the city recently and this has continued in the first quarter of the year. With such little space left, occupiers looking for Grade A accommodation will be forced to consider pre-let opportunities.”

ABERDEEN

Total transactions during the first quarter of 2016 reached just 34,624 sq ft in Aberdeen, which was the second lowest level in the past ten years as the low oil price continues to impact on demand.

The largest transaction to take place in quarter 1 saw the Crown Office and Procurator Fiscal Service acquire 10,537 sq ft of refurbished space at AB1 on Huntly Street. Further positive news was recently announced with PwC acquiring the 10,040 sq ft top floor of The Captiol, a recently completed speculative city centre office development.

Despite the lower levels of demand witnessed recently, small increases in Crude prices to c.$40, since a low of c.$33 in January, have signalled a more optimistic picture for the year ahead.

Total available supply at the end of the first quarter reached a new high of 2,029,122 sq ft; this represents a year-on-year increase of 59% from the first quarter of 2015 and a quarter-on-quarter increase of just under 11% from Q4 2015.

Prime headline rents in Aberdeen are once again unchanged at £32.00 per sq ft, however the details of the PwC letting remain confidential. As yet there are no signs that headline rents for prime Grade A space have suffered due to the low oil price and are forecast to remain stable throughout the course of the year.

Derren McRae, managing director of CBRE in Aberdeen, said: “Despite the drop in oil price impacting on the general demand for office space, prime headline rentals levels have remained stable. The recent announcement of PwC acquiring space within The Capitol demonstrates that occupiers with lease events are likely to gravitate towards the new high quality office space coming to the market.”