Growing pressures on the oil and gas sector are forcing companies to review their corporate real estate strategies, according a new report by JLL.

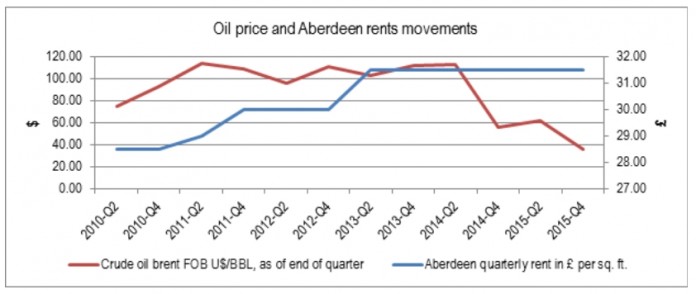

For oil producing regions and cities heavily exposed to the industry, notably Aberdeen, UK and Stavanger, Norway the impact of a low oil price has been significant. Falling demand for products and services from the oil sector has had a knock on effect on these markets, resulting in reduced workforce requirements and slowing demand for real estate. Space requirements from smaller players and oil service companies are likely to drop further as many may lack the financial resources of the oil majors to weather the storm.

However, it’s not all doom and gloom. As some larger and more financially robust companies are taking the opportunity to capitalise on the low oil price and acquire assets and stakes at below-market value, the industry is set to see some increase in targeted M&A activity in the near future. JLL suggests that those companies considering acquisitions should be preparing their real estate portfolios for the coming changes.

JLL’s Director Craig Watson comments: “In Aberdeen in particular there is a significant over-supply of office space, particularly from firms downsizing and disposing of surplus accommodation. Prime headline office rents are under pressure with increasing incentives, which is in itself an indicator of weakened real estate market. In this time of market uncertainty, occupiers are reluctant to enter into pre-let agreements and are increasingly concerned about flexibility, workforce requirements, and space optimization. Many have realised that they need a proactive long-term real estate strategy to be able to future-proof their business”.

An immediate response from the oil and gas sector has been to focus on cost cutting and postpone further spending. For many companies this has led to headcount reductions and asset divestments. In the most acute examples, market pressures are forcing businesses to file bankruptcies and default on loans. According to Standard and Poor’s data, the oil and gas sector contributed to over a quarter of the total global corporate defaults in 2015. A number of oil and gas companies, especially those with low debt to equity ratios, are expected to explore options for raising capital and increase borrowing.

As real estate is increasingly scrutinised for delivering cost savings, JLL has observed a clear focus on the following proactive strategies, in an attempt to response to market pressures:

1. Portfolio analysis and review

· Forensic review of all assets with a focus on high-cost and underutilised locations

· Identifying hidden vacancy and grey space

· Right-sizing of the portfolio and consolidating space

2. Cost reduction

· Review of high cost production locations and associated real estate requirements

· Identification of savings from high cost real estate offices

· Subletting or release of excess space

· Lease restructuring for core locations

3. Monetisation of assets

· Greater focus on capital raising and exit options from core and non-core operational portfolio

4. Increasing flexibility and agility of the portfolio

· Workplace and space optimisation

· Active use of break options

· Preparation of portfolio for M&A and divestment activities

Surveyor, Ben Dobson added: “While immediate market pressures force oil and gas companies to focus on cost reduction, there is still a strong argument for building a real estate strategy that can support the wider strategic objectives around growth, innovation, and talent. Growing global concerns around talent encourage business leaders to evaluate their workplace environments. For oil and gas companies this is a great time to tackle pending talent shortfall as the current generation of senior executives begin to look towards retirement. Forward-looking companies are shaping their real estate strategies today around the talent needs of tomorrow.”