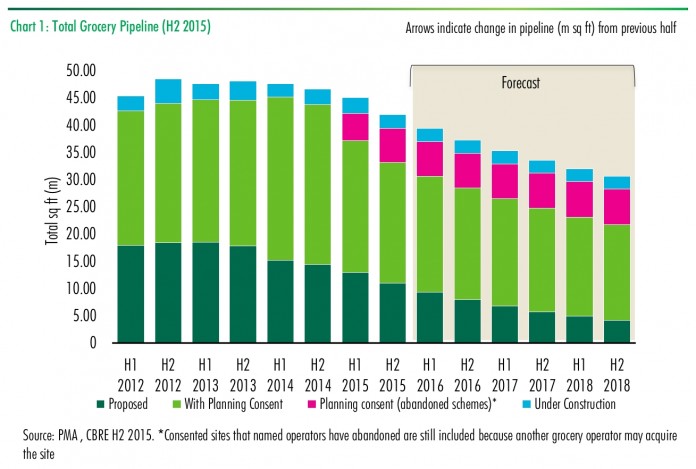

The grocery pipeline continues to shrink as Tesco, Asda, Sainsbury’s and Morrisons reduce the amount of new supermarkets they plan to open, according to CBRE’s UK Grocery Pipeline report, H2 2015:

The number of abandoned schemes has grown since H1 2015 with constructions and planning application also in decline.

In the future Aldi and Lidl will be the main contributors to the grocery pipeline to support their ambitious UK store targets. Tesco, Asda, Sainsbury’s and Morrisons are likely to submit significantly fewer planning applications for new stores than in previous years due to their large banks of consented sites.

The increase in new grocery stores in 2016 and beyond will also be driven by new convenience store openings. The number of new larger superstores will remain low for now as the operators invest in their existing estate to try and win back customers who have deserted them recently.

Some of the poorer performing hypermarket formats from Tesco, Asda and Sainsbury’s will continue to pose challenges. To address the excess space in some of these stores, further complimentary concessions (e.g. Burton/Dorothy Perkins trials in Tesco and Decathlon in Asda) will open. Sainsbury’s trial of in-store Argos concessions has been a success and they have recently submitted a £1.3bn bid to acquire Home Retail Group, following the separate sale of Homebase.

Store closures are expected to slow compared with 2015. Morrisons recently announced the closure of 7 medium sized supermarkets during 2016, but we don’t expect a further programme of closures from them. Sainsbury’s have said they have no plans to close stores. We expect a limited number of closures from Tesco where leases are not renewed at poor performing stores. A question mark remains around Asda whose UK performance has not been as strong previous years, and has recently seen weaker market share growth (according to Kantar). Their parent company Walmart have recently announced a closure programme of 269 stores in the US and in South America but there has been no news on any planned Asda closures in 2016.

Online grocery sales are expected to increase further in 2016 as consumer attitudes continue to shift.