High levels of take-up and strong occupier demand led to a good year for regional office markets in Scotland in 2015, according to leading property consultant CBRE’s H2 2015 Office Market View research report.

EDINBURGH

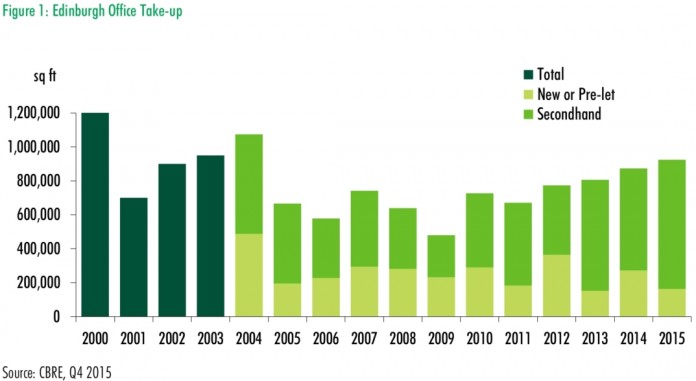

H2 2015’s remarkably strong office take-up of 520,152 sq ft pushed the Edinburgh 2015 overall total to 924,136 sq ft, the highest volume since 2004. The H2 figure was boosted by three transactions over 50,000 sq ft to FanDuel, The University of Edinburgh and JP Morgan.

Strong demand in H2 also led to pre-letting activity in the capital this year. Following the FanDuel deal (circa 58,500 sq ft) at Quartermile, the remaining 70,000 sq ft was pre-let to software firm Cirrus Logic.

Occupier demand in 2015 was dominated by the creative industries, business services and public sector. Looking ahead, healthy demand is anticipated with various lease breaks and expiries falling in the next 36 months and several large live requirements. The dearth of space in the short term is forcing occupiers to consider options earlier.

Total office availability at the end of 2015 was 1,444,264 sq ft, 30% lower than at the end of 2014 and 40% below the five year average. Of the total available space just 146,746 sq ft, or 10%, is brand new, Grade A, city centre accommodation.

With the current supply shortage and increasing weight of occupier demand, confidence amongst developers is growing. There are three schemes moving towards the start line: Capital Square (122,000 sq ft), funded by Hermes Real Estate, 2 Semple Street (37,500 sq ft), funded by GSS Properties and Quartermile 3 (74,000 sq ft), funded by M&G. Next in line are The Mint Building (60,000 sq ft) in St Andrew Square and the first building at The Haymarket, Haymarket 5 (91,000 sq ft).

Prime rents in Edinburgh increased to £31.00 per sq ft in H2 2015. They are expected to keep rising across all levels, including Grade B space, due to a lack of good quality secondary buildings; the only refurbished Grade B space entering the market is 40 Torphichen St (54,400 sq ft). Incentives didn’t move much in 2015 and although they are likely to become more common in 2016, the long term trend shows little deviation.

Stewart Taylor, senior director in CBRE’s National Office Agency team in Edinburgh, said: “The pre-letting of all 128,600 sq ft at Quartermile 4, three months before practical completion – a record for the city – is a significant milestone in the current development cycle. It will place further pressure on occupiers with potential requirements within the next five years to move early and quickly. The growth of the technology sector is also likely to influence the specification of the next wave of development.”

Investment transactions in the Edinburgh office market totalled circa £380 million in 2015, marginally ahead of the previous year and pre-recession levels.

In the second half of the year there were seven deals including the sale of Standard Life House at 30 Lothian Road for £93.75 million (the largest transaction of the year), the multi-let 102 Westport for £32.2 million and the Sainsbury’s Bank HQ at 3 Lochside Avenue, Edinburgh Park for £19 million.

Interest came from a variety of sources including German, US and Middle and Far Eastern investors. As with other regional centres, interest from UK institutions appears to have cooled toward the end of the year.

The dynamics of limited supply, healthy take-up, a development lag and predicted rental growth, imply that current yield levels are sustainable for the foreseeable future.

The positive market momentum looks set to continue into 2016 with the sale of Atria, one of the largest office buildings in the city, due to complete in Q1. A number of large sales are slated for early 2016 including Aberdeen Asset Management’s Exchange Place, with an asking price of £85 million.

GLASGOW

The Glasgow office market performed relatively well in 2015 with a total take-up of 562,290 sq ft, underpinned by strong occupier demand. This level sustains the recovery seen in the market since 2013, with take-up 6% above the five year average. Take-up half way through the year was more subdued however and it was Q3 before occupier demand increased, ensuring a strong finish to the year.

Grade A activity increased significantly towards the end of the year with 36% of total Grade A take-up occurring in the final quarter. KPMG took 39,700 sq ft at St Vincent Plaza making it the largest letting of 2015.

Total supply at the end of Q4 2015 was almost the same as one year ago at just 1.7 million sq ft. The stock of Grade A floor space is eroding quickly with the three new speculative schemes – St Vincent Plaza, 110 Queen Street and 1 West Regent Street – having already let a significant amount of space, with more occupiers showing interest.

Whilst the city benefits from a number of development sites with existing planning consent, there are no new site starts at present. The strong market dynamics have created a favourable environment for speculative development in the city and this may lead to one or more developments starting on site during 2016 with delivery in mid to late 2018.

Audrey Dobson, senior director in CBRE’s National Office Agency team in Glasgow, commented: “Whilst there are several office refurbishments underway it is disappointing that no speculative developments have commenced in the city. If occupier demand continues at current levels it is likely that occupiers seeking Grade A floor space will be forced to go down the pre-let route.”

With prime rents in Glasgow now standing at £29.50 per sq ft, the impending shortage of Grade A floorspace and the lack of new speculative development has already resulted in rent free incentives reducing which is likely to stimulate rental growth. Secondary market rents may also see significant increases resulting from constrained supply.

The city’s occupier outlook for 2016 remains positive with healthy occupier demand from both indigenous occupiers and increasing interest from companies not currently located in the city but attracted by the underlying labour dynamics.

Glasgow’s office investment activity in 2015 totalled just over £353 million, the highest level seen in the city since 2010. H2 levels increased substantially with an upturn in refurbished Grade B and Grade A office stock. With a severe lack of new development in the city centre, much of the stock likely to be traded in 2016 will remain in this vein.

The investments are dominated by UK and overseas private equity and foreign investors, a trend set to continue with a number of large assets, including CityPark, under offer to overseas investors.

Glasgow has not reached a position of over pricing and is unlikely to do so. The lack of developments in the pipeline combined with positive rental growth projections should ensure that investors will continue to be attracted to the city’s strong investment fundamentals.

As with the occupier market, the forthcoming Scottish elections and the spectre of another referendum may restrain some investor activity as the year progresses.

ABERDEEN

Office space take-up in Aberdeen in 2015 declined to 399,290 sq ft, the lowest annual total since 2010. However, this trend was to be expected given the weakening price of Brent Crude oil, which declined from $109 per barrel at the end of H2 2014 to $37 by the end of 2015.

Nevertheless, three large pre-let transactions took place in H1 2015, all in out-of-town locations: Anderson Anderson & Brown and Lloyd’s Register committed to 45,000 sq ft and 100,000 sq ft respectively at Prime Four Business Park and KCA Deutag acquired 70,000 sq ft at City South.

H2 saw the falling oil price having more of a clear impact on occupier activity. However, some occupiers are using the opportunity to move to better quality new Grade A space. The largest letting in H2 was to Amec Foster Wheeler which acquired 42,812 sq ft within EnQuest’s new Annan House HQ. The remaining deals were largely in the sub-5,000 sq ft size bracket.

Derren McRae, managing director of CBRE in Aberdeen, said: “Whilst the drop in oil price has naturally impacted on the general demand for office space, occupiers continue to explore opportunities to relocate to more efficient and higher quality accommodation. In recent years tenants have had no alternative option but to commit to pre-let developments; however, occupiers with requirements or upcoming lease events are now able to consider a variety of good quality ready-to-occupy options or indeed space within the Grade A speculative developments which are nearing completion.”

Availability at the end of 2015 increased to 1.8 million sq ft, 78% of which is second-hand Grade B stock, and there was 397,731 sq ft of office space either newly completed or under construction. Given current market conditions, no new speculative development is likely to start in 2016 however positively there is some pre-letting activity in the market.

Prime rents in the city have remained at £32.00 per sq ft, albeit there has been a lack of transactional evidence in H2. It is expected that prime rents will remain at current levels with an increase in incentives.

Activity in the Aberdeen investment market continued to be subdued in H2 2015, reflecting market sentiment on the back of low oil prices and a reduction in occupier demand. A total of £66.93million worth of deals concluded in H2, the highlight being Rockspring’s purchase of Annan House from EnQuest for £44.1 million reflecting a yield of 6.35%. The total investment volume for 2015 was £90.43 million compared to £531 million in 2014.

H1 2016 is expected to be quiet on the transactional front although depending on motives and price aspiration, there could be more activity in the second half of the year. Investors are likely to hold stock on long term leases until the local market recovers.

Some oil and gas related companies who owner occupy properties in Aberdeen may look to release capital tied up property assets by undertaking sale and leasebacks. Assuming that there is a strong underlying covenant, long term leases and geared uplifts, there is still a market for these opportunities, albeit at slightly discounted pricing.

Until the green shoots of recover begin to appear in the occupational oil and gas market, there is unlikely to be any movement up the risk curve. Limited interest is anticipated in secondary assets due to concerns over new build Grade A supply coming through the pipeline and excess sub-let stock flooding the market. Some buildings may need to be re-priced for alternative uses.

The Aberdeen office investment market is still good value for long term leases in comparison to some other regional markets although yields are predicted to move out in 2016.