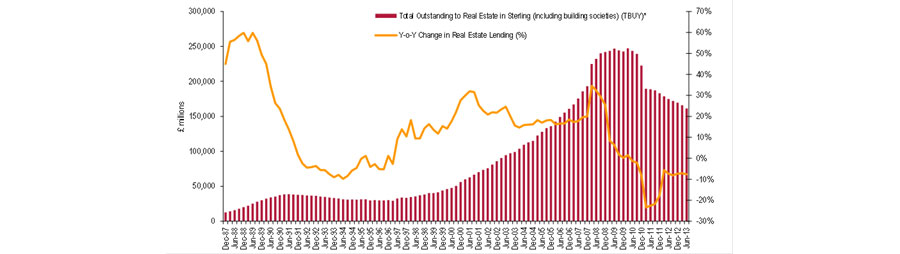

UK bank exposure to real estate has seen a slight decline over the last year in spite of renewed optimism in the lending markets. According to the latest Bank of England quarterly lending figures, the proportion of lending to real estate (as a percentage of total lending) stood at 8.1 per cent in Q2 2013, compared to 8.2% in Q1 2013 and 8.6% in Q2 2012.

Steven Fanrdell, Director of Valuation Advisory at Jones Lang LaSalle’s Southampton office, said: “There has been a notable improvement in sentiment in the lending markets, with growing appetite from lenders to finance not only prime but also good secondary real estate. The fact that outstanding lending continues to decline in spite of the improved market dynamics suggests that banks are continuing to run a twin track programme of exiting their legacy lending positions at the same time as originating new debt.”

David Lebus, Associate Director, Corporate Finance at Jones Lang LaSalle, added: “According to the latest Jones Lang LaSalle UK Investor Confidence survey, over 50% of respondents felt that debt had become more available not only for prime but also good quality secondary assets. This backs up our view that regional lending is increasing and that financing is now available for a wider range of assets than one year ago”.