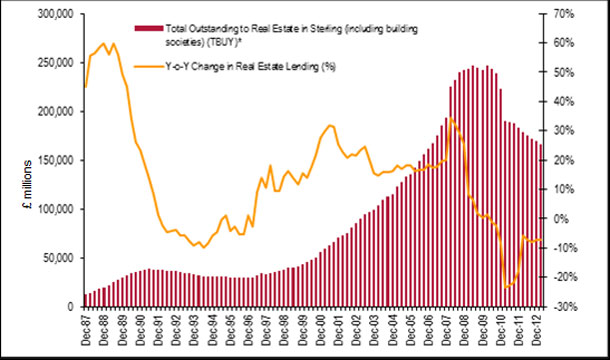

UK bank exposure to real estate (the proportion of lending to real estate a percentage of total lending) remained stable in Q1 2013 at 8.2 per cent of all debt according to the latest Bank of England quarterly lending figures.

UK bank exposure to real estate (the proportion of lending to real estate a percentage of total lending) remained stable in Q1 2013 at 8.2 per cent of all debt according to the latest Bank of England quarterly lending figures.Malcolm Barber, Director of Valuation Advisory at Jones Lang LaSalle, said: “In spite of continued deleveraging by UK banks, real estate lending has remained broadly flat as a result of growing appetite from lenders to finance prime real estate. Arguably, the debt market is now being constrained by a lack of investment transactions, as opposed to earlier in the current cycle, when the opposite was true”.

David Lebus, Senior Consultant in Corporate Finance at Jones Lang LaSalle, added: “The debt market continues to show signs of improvement, with an increasing number of lenders seeking to lend, albeit on a relatively narrow range of opportunities. Some lenders are taking advantage of the Funding for Lending scheme which has been extended for a further 12 months, and may help further underpin the market recovery”.

Source: Bank of England, Jones Lang LaSalle