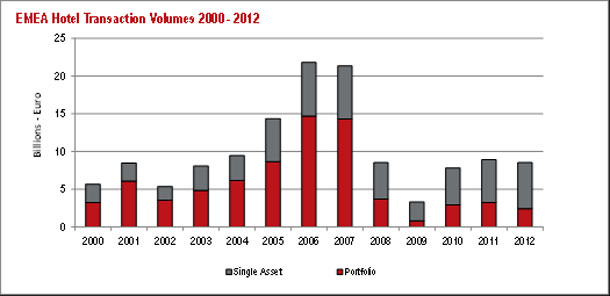

Despite volatility around the Euro Crisis in 2012, hotel investment activity held comparatively steady with transaction volumes reaching €8.5 billion, reflecting a 4% decline on volumes reported in 2011. The most liquid market was once again the UK with transaction volumes of €2.3 billion followed by France at €1.7 billion and Germany at €1.2 billion.

Despite volatility around the Euro Crisis in 2012, hotel investment activity held comparatively steady with transaction volumes reaching €8.5 billion, reflecting a 4% decline on volumes reported in 2011. The most liquid market was once again the UK with transaction volumes of €2.3 billion followed by France at €1.7 billion and Germany at €1.2 billion.

Paris and London were a magnet for foreign capital, primarily for cash-rich investors from the Middle and Far East regions accounting for roughly 40- 50% of total transaction volumes in these respective countries.

The most dominant buyers of hotel real estate were institutional investors, who increased their market share from 17% of the entire investment value in 2011 to 24% in 2012. These risk-averse investors, often in the form of pooled funds, were very active in Germany. Their focus was primarily concentrated on assets in core markets subject to stable leases.

Jonathan Hubbard, CEO Northern Europe Jones Lang LaSalle Hotels & Hospitality said “Stable volumes reflected continued investor confidence in hotel real estate, which remained an attractive asset class particularly for a growing number of overseas investors. International buyers from the Middle East and Asia, often in the form of large pension funds, sovereign wealth funds and private individuals, have in many cases started to replace the more traditional sources of capital. There has also been significant interest in the UK regional markets from these types of buyers, as well as private equity funds, who have recognised that notwithstanding the short term challenges in the market, timing is now good for investment in an established and robust market. The recent sale of the 42 strong UK Marriott portfolio is the largest UK hotel portfolio transaction to complete since the financial crisis of 2007/2008 and represented a significant vote of confidence in the European hotel market by international investors. This market confidence looks set to continue with sale of the Principal Hayley Group in the UK”

Christoph Härle, CEO Continental Europe Jones Lang LaSalle Hotels & Hospitality commented “Investor confidence was also backed by resilient operating results in a number of key markets. This was especially the case in Paris (+8.5%) and Germany where strong growth in Revenue Per Available Room (RevPAR) was seen in Berlin (+8.6%), Frankfurt (+5.1%) and Munich (+8.5%). Even in Spain, a country largely effected by the recession, hotel performance across the country remained relatively robust. Barcelona for example witnessed a RevPAR growth of 3% at year end. Both France, in particular Paris, and Germany saw an increasing inflow of international and regional institutional capital due to the stable performance and in Germany of the robust economic and political environment.”

Further growth in trading performance is expected in a number of European markets in 2013 as worldwide travel continues to expand and we anticipate a continued increase in foreign arrivals into Europe from emerging economies in Asia and South America.

Jonathan Hubbard, CEO Northern Europe Jones Lang LaSalle Hotels & Hospitality comments on debt availability in Northern Europe: “Nonetheless, a major constraint remains the persistent financing problems, with limited debt availability for new hotel acquisitions. Some improvements, however, can be expected in 2013 as new players such as insurance companies and pension funds start to fill the funding gap. Some banks have also strengthened their balance sheets and are likely to provide more funding to the sector going forward.

Christoph Härle, CEO Continental Europe Jones Lang LaSalle Hotels & Hospitality adds “Financing in continental Europe also remains a key challenge, in particular in the economically volatile countries such as Spain, Italy and the CEE region. However in key performing countries such as France, Germany and Benelux, financing is somewhat easier. Also, in light of a number of major high-profile deals either having exchanged or closed in the first two months of 2013 across Europe it could be possible that volumes would exceed our forecast of a flat €8.5 billion in 2013.”