Rising vacancy, declining rents and longer rent-free periods represent opportunities for London’s office occupiers to cut operating costs, according to the latest analysis from Carter Jonas. Carter Jonas’s Tenant Representation and Research Teams have recently completed their London Office Market Update, Q3 2020.

Rising vacancy levels

The capital is already witnessing an increase in the volume of second-hand, surplus, ready fitted out space being brought to the market by tenants, reflecting reduced headcount and a need to minimise exposure to real estate costs.

Michael Pain, Head of the Tenant Advisory Team, Carter Jonas, commented:

“Vacancy levels are set to increase in the new space office market as developments that commenced during the 2018 / 19 construction cycle reach completion. However, the exposure of some developers to non-income producing floor space will, in some cases, be ameliorated, reflecting the fact that a significant number had entered into pre-letting agreements with tenants early on in the construction programme, before the outbreak of the COVID-19 pandemic.

“However, this raises the possibility of those tenants that committed to leasing large tracts of floor space on pre-let agreements now offering some of that space to the market on sub-leases, following a reassessment of their floor space needs in the wake of COVID-19. Landlords of new developments that have been part pre-let could therefore find themselves competing for a dwindling number of footloose occupiers with the very tenants that they had earlier pre-let space to.”

Rents set to decline

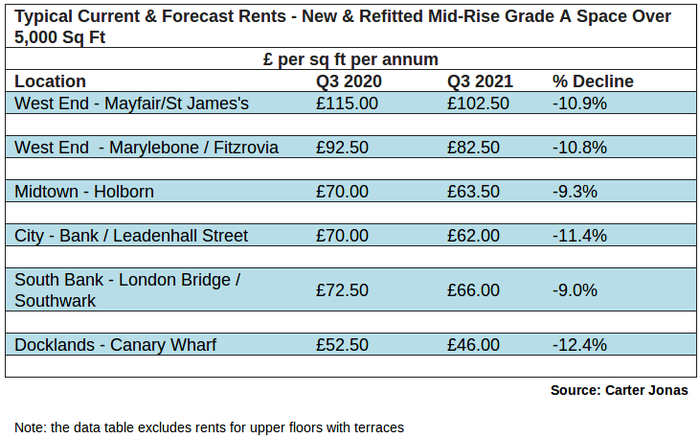

While landlord’s advertised rents have remained broadly static since the onset of the COVID-19 pandemic, over the next few quarters it is likely that reductions in rents will become widespread. Competition is expected to intensify between landlords with vacant new and refurbished space, and tenants that are offering new, surplus, pre-let Grade A space and second-hand, lower cost, ready fitted out “plug in and go” accommodation on flexible sub-leases.

Pain continued: “It is anticipated that rents for Grade A space will hold up better in the West End, Midtown and South Bank sub-markets which, prior to the onset of the COVID-19 pandemic, were characterised by acutely low vacancy. Rents in these locations are likely to decline by around 10% over the next 12 months. Contrast with the City and Docklands which are both vulnerable to large and rapid swings in vacancy, reflecting the higher number of large space occupiers in these markets, where rents could fall by up to 15% over the same period.

“Although the forecast decline in London office rents may seem rather alarming, and to put the numbers in context, it should not be forgotten that rents for new and refurbished Grade A space fell by over 25% in many parts of London during the global financial crisis twelve years ago. I don’t think, however, that the market will fall by the same order of magnitude this time around because the economic shock precipitated by COVID-19 came at a time when office vacancy across London was at historic lows.”

Rent free periods

Carter Jonas’s third quarter research includes analysis of rent-free periods.

Dan Francis, Head of Research, Carter Jonas, said:

“While rents have been broadly static, rent free periods have widened significantly since March this year. This reflects the fact that landlords are now having to compete quite aggressively with each other, as well as with tenants that now have surplus space, to secure lettings from a considerably smaller pool of footloose tenants. Our latest research shows that rent free periods in the London office market have increased by up to 4 months since the end of March to, typically, 12 – 16 months for a 5-year lease.”

Opportunities for commercial tenants

Rising office vacancy, weak demand, declining rents and an expansion of rent-free periods are likely to be the hallmarks of the London office market for the foreseeable future. These factors present opportunities for tenants that are facing a lease expiry or break option – by offering more choice and falling real estate costs.

Pain concluded: “With businesses looking at ways to reduce their operating costs in a challenging economic environment, current market conditions are providing greater opportunities to secure lower real estate costs and tenant-friendly lease terms.”