As highlighted in recent BNP Paribas Real Estate Cycology research, investors are still attracted to London, despite the uncertainties created by the Brexit vote. London is one of the world’s most liquid real estate markets and offers safe haven status at times of global uncertainty. Whilst London is not without its cyclicality, the huge infrastructure projects underway, including near introduction of Crossrail, the Northern Line tube extension into Battersea and Nine Elms, the proposed electrification of the West Coast mainline and a new runway at Heathrow will all help to open up new areas for real estate investors, as well as help attract new entrants into the Capital.

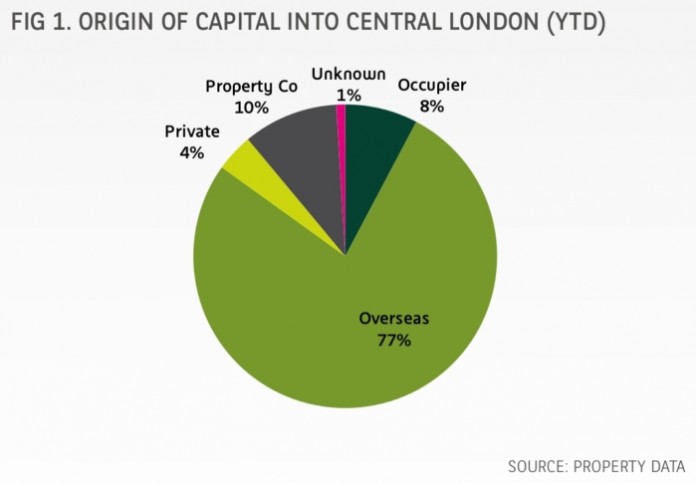

Fourteen deals have completed so far in London, in excess of £100m, in-line with the quarterly averages seen over the last five years (2012-16). As highlighted in the BNP Paribas Real Estate February Investment Monthly, it is overseas investors that are continuing to drive volumes and have accounted for 77% of investment into London.

In the immediate aftermath of the EU Referendum, it was the capital values of London, and particularly City of London offices, that were most impacted. However, so far this year, London has attracted the majority of investor focus with 60% of the UK’s total deal volume being in the Capital.

Whilst the performance of real estate as a whole has been robust, investment volumes are down year–on- year, but some context should be given to this. Before the exceptional years of 2014 and ’15, average UK quarterly volumes totalled c. £8.5bn. Q1 of this year is already in excess of that number and we anticipate to be closer to £9.7-10bn by the time the final numbers are rounded up.

The sector of the property market that is currently witnessing the strongest growth, and has been for some time now, is the industrial sector, with monthly Total Returns at 1% and Capital Growth of 0.5% for February. No other sector saw Capital Growth greater than 0.1% in the month. On an annual basis, industrial Total Returns reached 7.5%, with Retail (1.4%) and Office (0.6%), lagging behind significantly, largely due to the fact that annual capital growth for Industrial remained in positive territory (1.5%), versus Retail (-4.5%) and Offices (-4%).

MSCI’s Monthly Index saw the sixth consecutive positive Total Return at the All Property Level, with the falls and overly bearish sentiment of summer 2016 yet to resurface. Investors and occupiers are seemingly back once again to focusing on property fundamentals rather than political events.