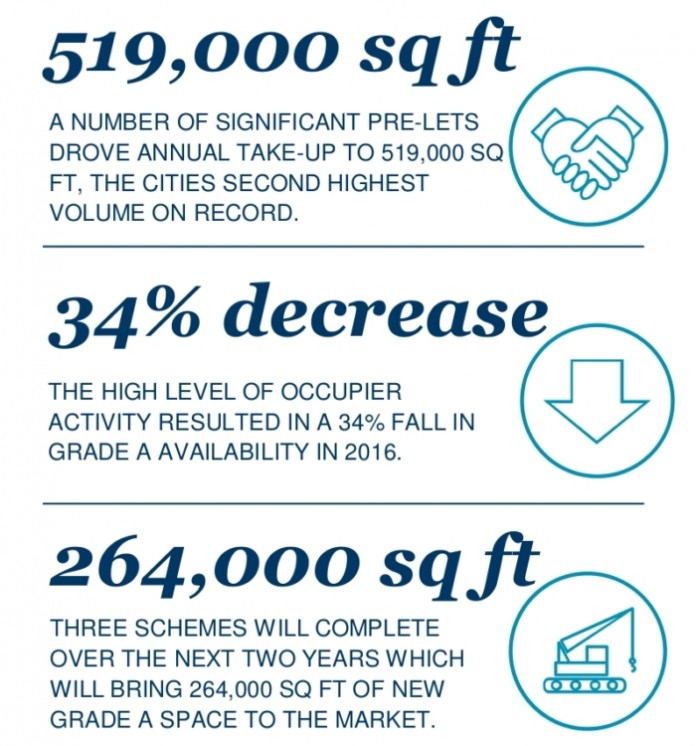

Cushman & Wakefield has released its Q4 2016 ‘Snapshot’ report on the Cardiff office market – showing that total Cardiff office take-up in 2016 reached 519,000 sq ft.

Occupier View

Chris Terry, Associate, Cushman & Wakefield in Cardiff:

“The city centre market continued to dominate activity representing 70% of all office space transacted in Cardiff last year. Cardiff’s prime headline rent, which has been stagnant for over a decade has now increased and is firmly established at £25.00 per sq ft at One Central Square.

“Looking forward into 2017, we expect to see further pre-let office activity in Cardiff City centre to include Cardiff School of Journalism (35,000 sq ft) and the Government Property Unit (circa 250,000 sq ft). These two requirements in addition to the active requirements already in the market should lead to another year of high take-up figures. With limited existing Grade A space and diminishing levels of good quality Grade B office stock, it’s likely that the market will witness a hardening of incentives being offered to prospective occupiers.”

Investment View

Andrew Gibson, Partner, Cushman & Wakefield in Cardiff:

“Investor appetite for Cardiff offices remains strong with a continued shortage of quality Grade A accommodation and very limited good quality Grade B stock, driving rental growth. 2017 is likely to see continued investor demand in to the Cardiff office market, continuing its performance as a strong regional centre. In particular, institutional interest is likely to be focused on the number of new funding opportunities that could become available throughout the year. With interest rates looking to remain at record low levels, Property Company and private equity investment is also likely to feature strongly in 2017.”