Office take-up in the South East of England in the final quarter of 2016 finished ahead of forecasts at just over 731,000 sq ft according to Colliers International, suggesting that post-EU referendum uncertainty has had little impact on occupier’s real estate strategy. Moreover, in excess of 450,000 sq ft is currently under offer, indicating a promising start to 2017.

The high demand for quality office space in the South East is further encouraging occupiers to increase pre-letting activity. Examples include Amadeus taking 87,00 sq ft at Heathrow and Network Homes taking 59,000 sq ft at Wembley Park. There were also several major pre-commitments on existing buildings, most notably HMRC committing to 184,000 sq ft at Ruskin Square, Croydon, the biggest letting of 2016 in the region.

The availability of stock remains low at 7% below 2015 levels and 35% down on 2012. As prime supply falls and is not being replaced, pre-let’s may now emerge as a serious option for occupiers in 2017 through to 2019.

Over 850,000 sq ft of much needed new Grade-A space came to the market in 2016 either through new completions and refurbishments.

“Slough, Reading, Stockley Park and Uxbridge are the markets to watch in 2017 as new stock drives significant rental growth; albeit at a slower rate than anticipated pre-EU referendum. Occupiers are likely to focus evermore on incentives and lease flexibility in the next year as the market buffets continued economic uncertainty,” said Mark Emburey, Director at Colliers International.

Current quoting rents for these towns stand at:

• Slough: £32.50 (25 Windsor Road),

• Reading: £39.50 (R+)

• Stockley Park: £39.50 (The Bower)

• Uxbridge: £37.50 (Uxbridge Business Park)

All of these locations will set new rental highs once let.

Investment

Investment transaction volumes in the South East office market continued to feel the impact of a cautious, post-EU referendum market and totalled just over £1 billion during the final quarter of 2016. Total investment for the year in the South East office market was £2.85 billion which is down on the £4.475 billion transacted in 2015.

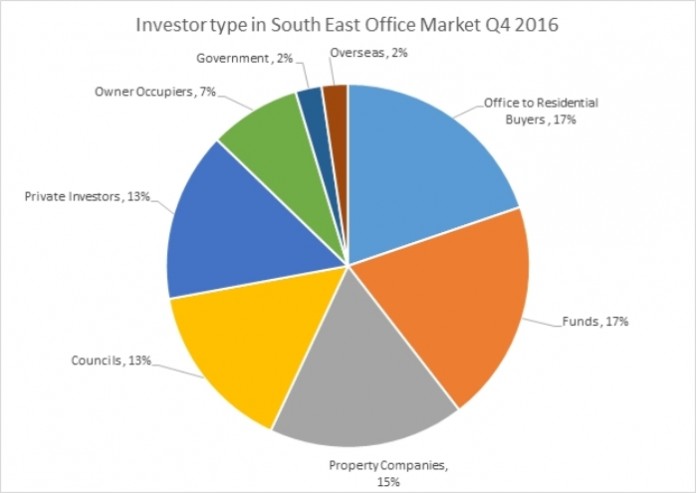

“While political and economic uncertainty negatively impacted transaction volumes for much of 2016, it would seem that the dust is now settling and we saw a diverse spread of investors chasing South East office opportunities towards the end of the year,” said Rob Cregeen, Director at Colliers International. “As 2017 picks up pace, we envisage a continued ‘flight to safety’ with investments in good quality town centre assets set to continue to trade well. Last year we saw a number of county and borough councils emerge as key investors, but we can expect to see the re-emergence of UK funds as keen buyers in 2017 too.”

Spread of South East Office investors in Q4 2016:

• Office to Residential Buyers (17%),

• Funds (17%),

• Property Companies (15%),

• Councils (13%),

• Private Investors (13%),

• Owner Occupiers (7%),

• Government (2%)

• Overseas (2%).