Leading property consultant CBRE has released the findings of its latest Scotland Property Quarterly report, with statistics showing industrials continued to be the strongest performing sector in Scotland at the end of Q2 2016.

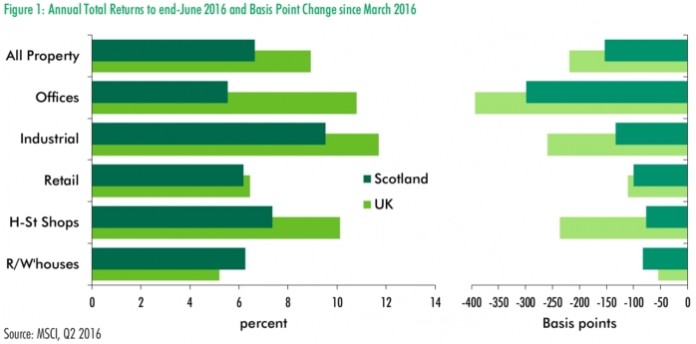

Quarterly returns for Scottish commercial property fell to 0.9% in the second quarter of 2016, down from 1.2% in the first quarter. It is the third successive quarter that returns have fallen, however the downshift over the course of Q2 has been much smaller than in previous quarters. Over the twelve months to the end of June 2016, Scottish total returns were 6.2%.

Industrials continue to be the strongest performer, with relatively stable returns. The sector produced a total return of 2.2% in Q2, a repeat of Q1. The sector was the only one to see capital values rise, by 0.6% over the quarter. This was in marked contrast to other sectors where rates of return have slipped. In addition rental value growth increased over the quarter to 0.9%, the highest quarterly growth rate since Q1 2015. It also has pushed higher the annual rate of rental growth to just over 2.1%, significantly ahead of rental growth in any other sector.

The clear drag on overall performance of Scottish real estate in Q2 has been the office market. Despite strong sales volumes in the first half for the sector, capital values have fallen by -1.5% over the quarter. Such capital losses were last seen in 2013 during the tail-end of the Eurozone crisis. This effectively reverses any capital gains made during the previous three quarters, with annual capital growth at -0.2%.

Total returns for Scottish retail fell modestly during Q2 to 0.9% for the quarter. For the second quarter in succession, capital values fell marginally by -0.4%, despite rental values growing by 0.3% over the quarter. Of all the main sectors, Scottish retail performance is the most closely aligned to its UK wide counterpart, with only around 20 basis points difference in the total returns for the two geographies.

For the first time since oil prices began their sharp fall in late 2014, annual total returns for Aberdeen offices have moved into negative territory at -0.75%. In contrast, returns in both the Edinburgh and Glasgow office markets are outperforming the All Scotland return of 6.6%. Both have posted annual returns in excess of 9.0%, also well ahead of the pace laid down so far this year by all offices on average.

Well ahead of the pack remains Edinburgh Industrials, with an annual total return of 11.8% in the twelve months to the end of June.

After a particularly strong first quarter, dominated by purchasing activity in the Edinburgh office market, investment volumes have significantly slowed in Q2, falling to £245 million. This has brought total volumes for the first half of the year to £664m, and as a result almost half the volume of office investment from 2015 has already taken place after just three months.

In contrast investment into other sectors has continued to be much weaker. The largest retail transaction so far this year is the purchase of Cuckoo Bridge Retail Park in Dumfries by NewRiver Retail for £20.2m. Overall retail investment volumes in the first half of 2016 total £129m, compared to £317m over the same period in 2015. The big difference is the lack of any shopping centre transactions so far this year.

Aileen Knox, senior director at CBRE, commented on the findings: “Once again industrials continued to outperform other sectors in the second quarter of the year, and was the only one to see capital values rise over the quarter. This was in comparison to other sectors where rates of return have slipped.

“It will be interesting to see what the impact of the referendum result will be on the market for the rest of the year. However there is hope that the strong pre-referendum Q2 in the UK (0.6%) will feed through and maintain the modest but positive growth story in Scotland.”