Continental Europe is following the US and the UK into a phase of solid economic growth, rental growth is improving and there are opportunities to boost returns by investing in the region’s affluent second tier cities – according to the latest research published by leading global real estate fund manager, M&G Real Estate.

M&G Real Estate’s ‘Continental European Outlook’ reports that consumers are the driving force behind the region’s economic recovery, resulting in the Eurozone posting nine consecutive quarters of economic expansion and on track for more.

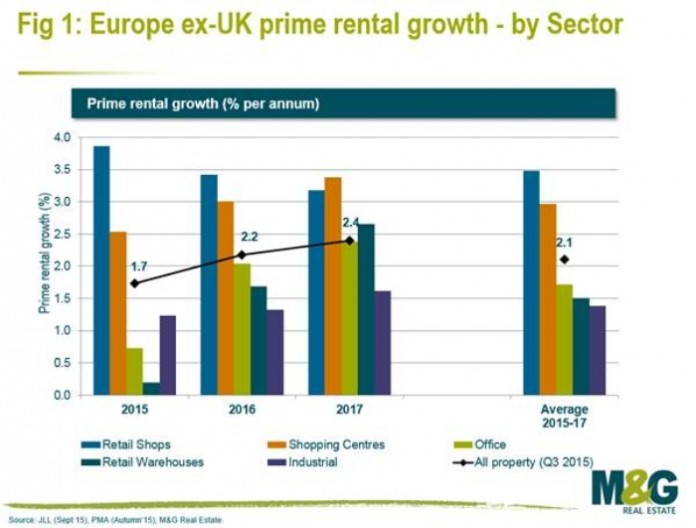

Rental growth

· Retail – High street shops and shopping centres in gateway European cities will continue to see the strongest rental growth as international retailers move into Europe to take advantage of increased consumer spending. Strongest rental growth predicted for main Southern European cities of Spain (3.6%) and Portugal (4.4%).

· Offices – Rental growth to spread beyond Europe’s top cities supported by the rise in office-based employment. Strong demand for space in undersupplied central business districts (CBDs) and further rises in prime rents expected over the next three years in the prime CBDs of Barcelona, Madrid, Stockholm, Copenhagen and Munich.

· Industrial – modest rental growth forecast for the undersupplied logistics sector as increased manufacturing activity drives demand for space. Retailers continue to expand their e-commerce networks and limited speculative development results in continued, strong and steady income streams for investors. Hot spots include Dublin, Barcelona and Madrid.

Investment volumes

· European investment volumes are on track to beat last year’s high and first half capital flows of €67 billion, up 33% year-on-year. With improving fundamentals and the competitive exchange rate, the overall figure for 2015 is set to hit an eight year high.

· US investors increasingly active across Europe with capital flows from the Americas in the first six months of 2015 reaching 70% of the volumes seen from the previous year.

· M&G Real Estate expects this trend to continue in the short to medium term, supported by the euro/dollar exchange rate. Continued strong investor demand for real estate to drive yield compression across the Eurozone, particularly in affluent tier two cities.

Vanessa Muscarà, Senior Research Analyst, commented: “Continental Europe is now seeing solid economic growth, with buoyant consumer demand, rising employment and improving lending conditions.

“Heightened occupier demand, driven largely by retailers upping their physical presence, is having a positive impact on rental growth across the region, with prime high street shops offering the best prospects for rent rises in the near term. We expect other sectors to do well over the coming years, resulting in an attractive investment climate for investors looking for a strong income stream at a time of low bond yields and base rates.

“With record capital flows targeting Europe’s gateway cities, encouragingly, we see the opportunity to further boost returns by looking further afield and investing in affluent second tier cities which offer greater scope for future yield compression.”