Property professionals in the South are more upbeat about the future, according to the latest insight survey by accountancy and investment management group Smith & Williamson.

Nearly 500 residential and commercial property executives were interviewed to gauge their thoughts for the firm’s 10th annual property survey, which provides a snapshot of market sentiment.

Developers, investors, agents, bankers and lawyers took part, with the findings likely to resonate with colleagues in Hampshire as the UK emerges from the severest recession of its kind in living memory.

Julie Mutton, a partner in Smith & Williamson’s assurance and business services team at the South Coast practice in Southampton, and a member of the firm’s property and construction group, said: “There is a palpable sense of optimism about both the residential and commercial property sectors, with a generally positive outlook for the next five years.

“This upbeat view of the future is in stark contrast to post-2008 when sentiment in our annual survey was understandably at a low ebb because of the UK’s prolonged economic difficulties.

“However, most respondents think it will still be two years before the real estate market returns to the pre-recession level of profitability.”

Optimism for the residential property sector has surged, with just over 15% of the respondents very confident of the sector’s performance and just over 73% reasonably confident. Last year only 1.5% of those surveyed were very confident, and nearly 24% were not very confident.

Taking a five-year view, 19% of respondents strongly agreed and nearly 58% agreed that now is a good time to make a residential property investment in the UK, with just 5.4% reporting concerns such as the risk of a housing bubble.

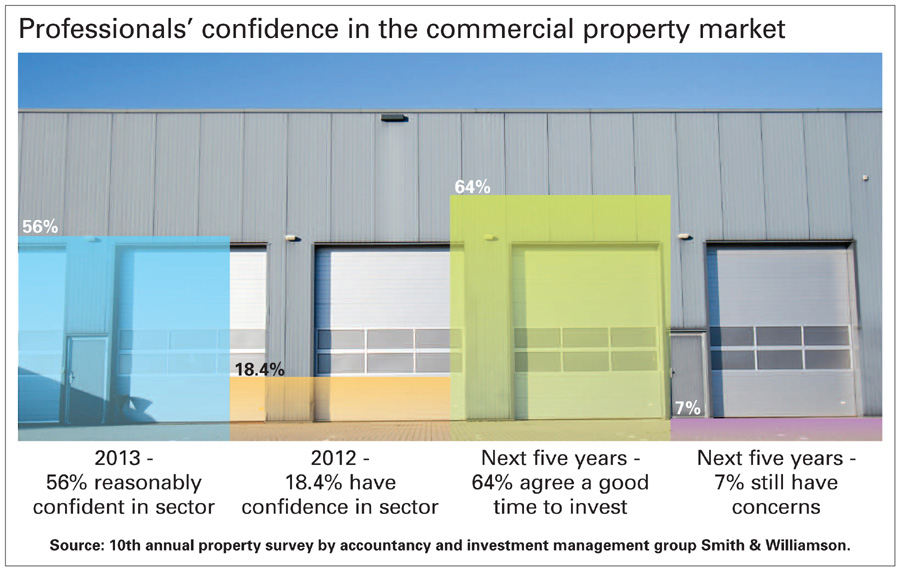

A similar trend appeared with commercial property: just over 56% of respondents were reasonably confident, in stark contrast to 18.4% last year. Nearly 7% were not very confident, compared with just over 32% last year.

Again taking a five-year view, just over 64% either strongly agreed or agreed that now was a good time to invest, as opposed to nearly 53% last year. Only 7% disagreed or strongly disagreed, compared to just over 12% in 2012.

In terms of key issues facing the property industry as a whole over the next 12 months, the UK’s economic performance came top, at just over 74%, followed by availability of bank finance, planning regulations, construction capacity and costs, availability of equity funding, government spending cuts, taxation costs, environmental regulations and attracting overseas funding.

At 62%, enhanced bank lending was the most popular way that respondents thought the UK property industry could be assisted.

This was followed by cutting property taxes and rates, relaxing planning regulations, using public funds to finance infrastructure, providing more tax reliefs for development, facilitating office-to-residential conversions, promoting Help to Buy and Build to Rent, inflating the UK economy as a whole and encouraging investment from overseas and deferring payments of property taxes and rates.

Biggest taxation issues facing respondents included rising business rates (nearly 19%), followed by VAT, stamp duty land tax and, jointly, corporation tax and income tax on profits.

Sources most relevant for raising finance over the next 12 months included clearing banks (39%), followed by other banks, private equity, asset disposals and share or debt issues.

Central London and Greater London, at nearly 40% and 21.5% respectively, are the regions respondents are most optimistic about over the next 12 months, followed by the South-East (just over 28%), South-West (6.3%) and Midlands (just over 2%).

At 36%, the North-East drew the most pessimism, followed by Northern Ireland (nearly 14%) and North-West (just over 13%).

Regarding environmental initiatives with a material impact on business, energy efficiency was just over 35%, followed by energy performance certificates and enhanced capital allowances.

Already affected by the recession and online shopping, the high street proved to be the sector which respondents feel the most pessimistic about for the next 12 months, at 38.5%, followed by retail (just over 17%), public sector (nearly 8%), office (nearly 13%), shopping centres (just over 7%) and industrial (just over 5%).